The modern monetary system in most countries uses a two-tiered structure of providing money to the economy which comprises of a central bank and commercial banks. Each country has one central bank that function as the single issuer of its sovereign currencies. It manages the currency of the country and controls the money supply to achieve price stability. The main objective of the central bank is to manage economic fluctuations. Commercial banks on the other hand provide basic banking services and products to their customers and small to medium-sized businesses. Its purpose is to accept deposits from people and provide loans and other facilities such as savings accounts, mortgages, as well as other services such as safe deposit boxes. There is no additional cost from the exchanges of payment instruments whether its cash, central bank deposits or commercial bank deposits. In fact, they are efficiently exchangeable with one another on a one-to-one basis. For this system to work smoothly a central bank oversees the monetary system and enacts the monetary policy of a nation or group of nations, regulating its money supply, and setting interest rates. However, the central bank has carefully avoided occupying the monetary infrastructure. Instead it allows private entities to innovate their own payment and settlement services and this has led to private entities creating various instruments within the monetary systems such as checks, wire transfers, ATMs, credit cards, debit cards, and mobile payments.

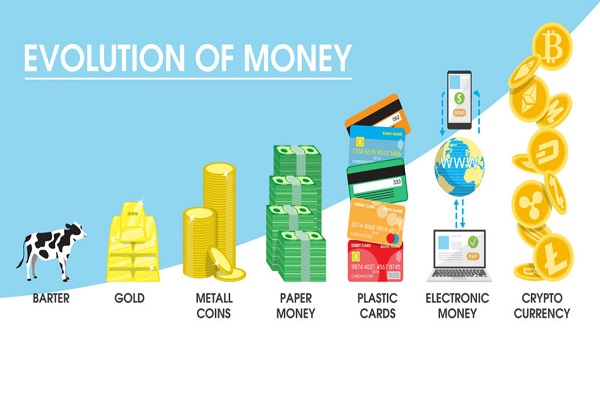

After the huge developments of payment infrastructures in the form of ATMs, credit cards, and debit cards fostered by electronics-based technologies, the period of the global financial crisis in 2008 saw the emergence of new digital technologies almost simultaneously.

Distrust of banks and central governments was at a peak during the period from 2007 to 2009 leading to one of the chaotic financial environments in U.S. history. Bitcoin, the first crypto-asset, was born during this period in 2009 alongside blockchain and other distributed ledger technologies (DLTs). Some businesses began accepting bitcoin in addition to traditional currencies from the mid-2010s. At the same time, the arrival of the iPhone in 2007, led to the widespread use of smartphones worldwide. The popularisation of mobile phones and smartphones has led to the drastic increase in the volume of data due to web-browsing, social networking service (SNS), e-commerce, and smartphone apps. These technological advances led to the emergence of a new industrial movement known as Fintech or financial technology – a term referring to software, mobile applications, and any new technology that aims to improve and automate the use and delivery of financial services. These financial services that include smartphones, AI, blockchain, and other DLTs has promoted financial inclusion where more and more people now have access to payment services through their smartphones. Although in the initial days Fintech mostly referred to the technology banks and other financial institutions used in their backend systems, but over time, its meaning has shifted to consumer-oriented services. Fintech now includes different sectors and industries such as education, retail banking, fundraising and non-profit, and investment management, to name a few. As most people are aware, some of the most active areas of fintech innovation revolve around the development and use of cryptocurrencies (Bitcoin, Litecoin, Ethereum, etc), digital tokens (e.g., NFTs), and digital cash. The concept of “money” is fast evolving as the use of cash, the only form of central bank money available to the public, is declining in many countries. The ongoing digitalization of the economy is changing the way people pay and the pandemic has accelerated this significantly. The current rate of digital innovations has brought about new challenges to the modern banking system. Let us explore some of them.

Cryptocurrencies:

A cryptocurrency is a digital or virtual currency that allows people to make payments directly to each other through an online system. In other words, cryptocurrencies are digital tokens secured by cryptography and organized by a peer-to-peer network called a blockchain. The blockchain technology is a distributed ledger that is shared among the nodes of a computer network. It is decentralised which means they are not issued by governments or other financial institutions and serves as a secure ledger of transactions, e.g., buying, selling, and transferring. In contrast to national currencies that are based on the credit of the economy and act like legal tender, cryptocurrencies have no legislated or intrinsic value. Instead, they have remained speculative investment targets and are simply worth what people are willing to pay for them in the market.

There are numerous cryptocurrencies now in use across the globe, out of which the most popular are Bitcoin and Ether.

Cryptocurrencies are not considered to be currencies in the traditional sense. Currently the use of cryptocurrency as a means of payment is limited and while varying treatments have been applied to them, they are generally viewed as a distinct asset class in practice. A nation’s currency is widely accepted as a means of payment as it is backed by a central

authority and hence it is comparatively easier to detect or resolve any fraud. Transacting in cryptocurrency is considered risky as the possibility of anonymous transactions makes it unsafe. With the absence of intermediaries or regulatory bodies, the speculation involved in cryptocurrency makes the currency volatile. Besides the problem of data hacking and fraud, massive consumption of electricity is required for their operation. There is a mixed usage of cryptocurrency across the globe depending on its legal status. Several countries allow Bitcoin to be used in transactions and have developed forms of regulation. The European Union has not made the usage of cryptos legal or illegal, but it recognises Bitcoin and other digital assets as ‘crypto-assets’. On the other hand, trading and exchange of cryptocurrencies are banned in some countries as they believe it can be used to support illegal activities such as terrorism, cybercrime syndicates, and money laundering.

Stablecoins:

Stablecoins are cryptocurrencies, the value of which is pegged to that of another currency, commodity or financial instrument. They are not issued by a central bank. They aim to provide an alternative to the high volatility of popular cryptocurrencies like the bitcoin and ethereum which rapidly fluctuate in value.

The stablecoin market has grown to $134bn in circulation and has made crypto even more self-sufficient and less reliant on outsiders. Stablecoins have the potential to play an important role in the future of global finance. But it is not without controversy as some believe the asset backing is not quite what it seems. It was recently fined $41m by the US Commodity Futures Trading Commission owing to not having enough dollar reserves to back its currency. The Biden administration has recently recommended the use of stablecoins though with necessary regulatory measures as it could offer cheaper transactions, greater security, and wider financial inclusion within and across national borders. It has advised on the passing of legislation that limits stablecoin issuance to insured banks. Stablecoins pursue price stability by maintaining reserve assets as collateral and can benefit all sections of society as a medium of exchange.

CBDC:

With more than 12,000 cryptocurrencies in circulation across the globe, and one in ten people invested in them, central banks are faced with a parallel monetary system that’s completely out of their control. Finding it impossible to ignore the demand for digital currencies, central banks around the world are stepping up to create their own digital currency options called the CBDC (Central bank digital currencies). A CBDC is a digital form of central bank-issued money, whose monetary value would be identical to that of a country’s physical fiat money and would be exchangeable one-to-one with such fiat money. It represents money that’s a direct liability of the central bank and provides consumers with convenient digital payment options without exposing them to the volatility of cryptocurrencies. CBDCs could be used to automatically pay taxes or make other payments to the government with the help of smart contracts.

The shift toward cashless digital finance represents the largest opportunity for FinTech’s from building user-friendly transaction services for consumers to helping create a stable and scalable foundation for cross-currency transactions. CBDCs are run on distributed ledger technology managed overall by a central bank. Policies embedded within the currency and transaction code will help to hinder fraudulent activities that rely on anonymous cash transactions, such as drug deals and money laundering.

The costs of printing, transporting, and managing cash will significantly reduce though all the benefits demand a steep upfront cost as new infrastructure will need to be established. Cyber warfare and threats will be of top concern and upgradation of skills will be required in this new era of digital finance. Adopting this new technology will be particularly challenging for non-tech-savvy consumers and will lead to a greater tech inequality across society. In a CBDC driven economy, the role of international banks will completely transform especially when it comes to international and cross currency trade. The highly cash-oriented customer base of credit unions and co-operative banks will find the usage of CBDCs formidable and challenging. Similarly, there will be a period of transition, evolution, and confusion at some levels for corporate customers as they adapt to transacting with CBDCs. The infrastructure required for the implementation of CBDC will involve significant resources and carry innovation burden in the short term as the huge shift of operations will require banks to participate in new networks, work with new digital ledger types, and collaborate with FinTech’s.